Hi everyone,

I’ve been asked what does and does constitute a business expense for a writer. You absolutely must consult a tax person about this subject, but here are some practices I have followed for many years.

First, a writer is a small business person who may or may not make a profit in the early years. You don’t need to hang out a shingle or fill out a form. You merely have to be in the business of being a writer. Being in business requires certain expenses whether an editor accepts a manuscript during the year or not. Therefore, I keep careful track of paper for my printer, toner, pens, pencils, writing pads, stamps, mailers, research books, and other supplies required to do my work.

When I make a school visit, I keep track of my mileage and turn that in as a business expense. If I get paid for the visit, fine, but either way I had to pay for the cost of driving my car to and from the school. I also keep track of mileage if I attend a business related meeting such as a writers’ organization or a writers’ workshop. If airfare is involved, I save those receipts too. A trip to the library after research-related materials is another expense I have to remember to record.

In my case I have an office in my home. It’s a room where I do nothing else except writing-related activities. The room is equipped with two computers,one printer-fax-copying machine, three desks, built-in bookshelves and cabinets, a free-standing bookshelf, a filing cabinet, one side chair, and one chair where I sometimes sit when I write. There are some pictures on the wall that are related to my work. If I buy a new desk chair to replace the one I’ve worn out or need a new carpet, it’s a business expense. This is strictly a place of business and I treat it that way. At tax time, I deduct a percentage of household utilities, mortgage, and property taxes relative to the size of my office to the size of my house.

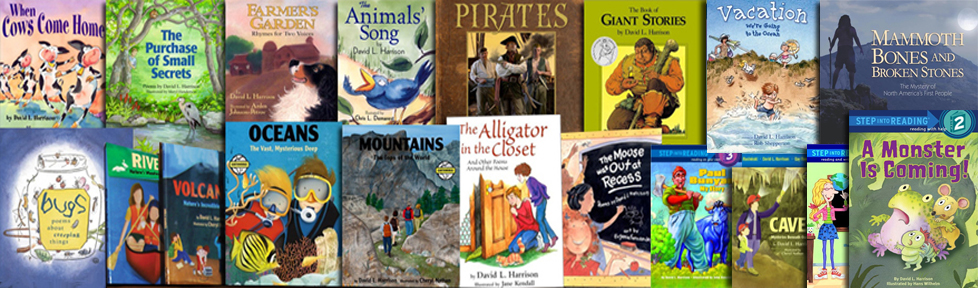

I deduct much of my Internet expenses. About all I use it for is to work on my writing, respond to editors and others who inhabit my writer’s world, submit manuscripts, and look up quick facts when I need them. I have a website and blog and they need to be maintained. I deducted the original cost of each as well as the annual feeds for maintaining them. Writers who have books in print are asked all the time for donations of their work. I don’t always accept but, when I do, I deduct my cost of the books I give away.

During the course of the year I take a few trips that are related to my activities as a writer. When I go to New York to see editors, I may stay an extra three days to see the sights. I only deduct that part of the trip during which I had my writer’s hat on. If I fly to a conference or workshop, I keep records of my meals, taxi, airport parking, etc. to turn in at the end of the year unless I’m being reimbursed for those expenses.

Again, these tips are about my own practices and they are done with the strict guidance of my accountant. If you have not yet started taking your own writing expenses as deductible items on your tax report, please do not take my word for what is or isn’t okay with IRS. There can be some surprises.

For example, years ago I donated several of my manuscripts and letters to the library on the campus of Central Missouri State University. Before donating the materials, I took them to a librarian who was an authorized appraiser of writing related materials. She appraised the boxes at $19,000 so that year I had a tax deduction based on the value of my donation. A few years later I prepared a new set of boxes to donate. I learned that congress had made a new law that rendered my work worth only the paper it was printed on. If the recipient wanted to give it to someone else, then it could be given at an appraised value, but the creator of the original work was only entitled to the value of the paper. Therefore I loaned the materials rather than give them away. If the law ever becomes more realistic, I’ll make it a donation.

One thing I’ve never attempted to deduct is a value I would place on services I give away. For example, I have a standard fee for school visits but once in a while I’ll do one (locally) for free. I don’t receive anything so I don’t try to tell Uncle Sam that I should deduct that school visit as a donation. Maybe I could because I’ve been charging for such visits for more than forty years. But it feels like a gray area and I try to avoid such situations that might raise an eyebrow somewhere along the line. Recently I allowed myself to be auctioned off for a pair of school visits as part of a fund raiser for Writers Hall of Fame. I didn’t receive the money so I won’t try to write those visits off on my taxes.

I hope this helps. If some of you have other thoughts or practices about what writers can and should deduct on their tax forms, please speak up. This can be a confusing area for all of us!

David